Understanding Solar Power Insurance

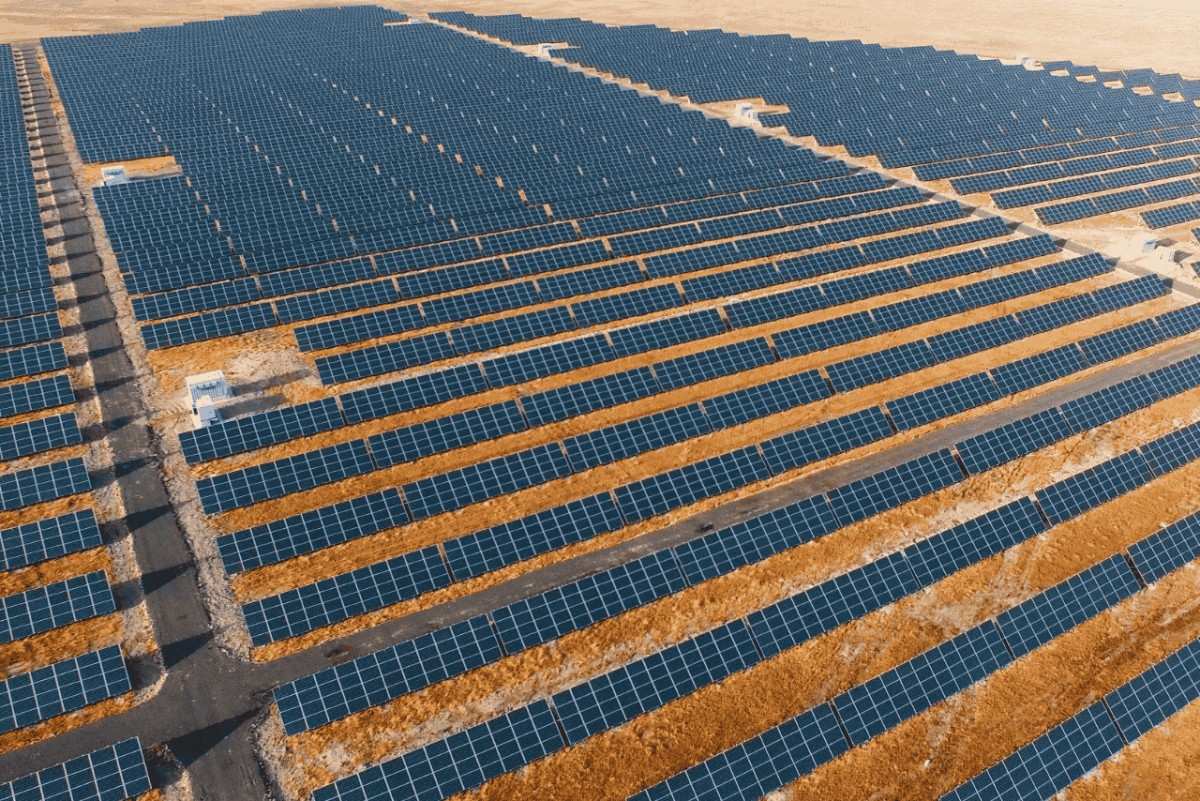

Solar Power Insurance provides comprehensive protection for businesses involved in the generation and operation of solar power. This includes coverage for solar farms, rooftop solar installations, solar panels and related infrastructure. The usual, one-size-fits-all business insurance policies often fall short of addressing the unique risks associated with your solar power projects. Whether it is during installation, construction or daily operation, a specialised Solar Power Insurance policy offers customised solutions that ensure your business is protected at every stage.

Solar panels and related equipment represent a significant investment. Solar Power Insurance helps safeguard these assets and operations by covering common risks like weather damage, equipment breakdown and other industry-specific hazards.

We are award-winning Solar Power Insurance experts

Risk Considerations Associated with Solar Power Insurance

The solar power industry is a crucial pillar contributing to the global transition to sustainable energy. However, such growth in this industry comes with a range of risks that could potentially have significant financial and operational impacts on your business.

Solar Power Insurance protects against severe weather damage, equipment failures, and third-party liability claims that could lead to costly repairs, delays, or legal action. This includes:

Why Solar Power Insurance is Essential

Solar energy projects need big, open spaces and are hence often situated in environments or locations that make them vulnerable to severe weather, technical faults and other operational challenges. Without adequate insurance, these risks could lead to substantial financial losses, project delays and damage to your company’s reputation. Inadequate insurance coverage could lead to irreparable costs.

Getting the right Solar Power Insurance provides peace of mind by ensuring your business is protected against these threats. This allows your business to focus on innovation and sustainable growth. With the right cover in place, you can pursue new projects and expand your operations knowing that you have a safety net if something goes wrong.

Having access to the right Solar Power Insurance professionals helps ensure your team remains compliant with industry regulations, avoiding hefty fines or penalties. In a heavily regulated sector like renewable energy, this guidance and compliance support are crucial to have.

Read our reviews

The team at Crucial Insurance were professional, thorough and helpful. Tony took the time to compare my existing policies with other competitive insurances on the market. He recommended options that provided me with the coverage I required and were more cost effective. Thanks for the great service.

Alishia was a pleasure to work with, great on the phone and extremely knowledgable on policies. In fact, this is the reason brokers exist --I could not find a single insurance company, despite hours and hours of searching, with a policy that did what I wanted. Alishia had one in mind within a minute of speaking with me, and not long after, I was covered. Outstanding.

Thankyou to Tony and the Crucial Team! Tony designed insurance specific to our business needs and made it easy to understand. We have peace of mind knowing that they are there to support us.

Choosing the Right Solar Power Insurance Policy

Selecting the right types and range of Solar Power Insurance policy requires a deep expertise of your business’s specific circumstances and risk profile. Our experienced advisors here at Crucial Insurance can assess your needs and source coverages that provide the most comprehensive protection for your solar operations.

Key considerations include:

By carefully considering these factors, you can be well advised by us on insurance plans that best fits your business, ensuring there are no critical gaps in coverage.

Why Choose Crucial Insurance and Risk Advisors for Your Solar Power Insurance

When it comes to protecting your solar energy business, you need more than just a generic insurance policy broker. You need a partner who understands the complexities of the Solar Power industry. Thankfully, Crucial Insurance and Risk Advisors is exactly what you need. Here’s what we offer:

By choosing Crucial Insurance and Risk Advisors, you are proactively investing in a safer and more secure future for your solar power business. With our support, you can confidently execute your operations even when unexpected events arise, knowing you have us to work with you to help your business grow sustainably.

Need to speak to an experienced expert in Solar Power Insurance? Contact us today.