The majority of businesses are now employing a remote workforce. Make sure you don’t open your network to cyber criminals in the process. Cyber Insurance and Risk Management can help protect you.

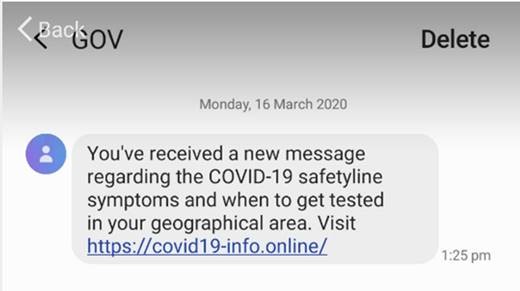

COVID-19 themed text messages appear to come from “GOV” as the sender. They include a link to find out when to get tested in your geographical area. These texts are a scam and if clicked on, may install malicious software on your device which is designed to steal your banking details.

To reduce your exposure to you need to ensure you implement good cyber risk management across your remote workforce. You should also have Cyber Insurance to protect your business from any financial loss that results from a cyber attack. We recommend your business strongly implement the following cyber risk management steps.

Take out Cyber Insurance to protect your business

A comprehensive Cyber Insurance policy can protect your business from the financial loss as a result of cyber attack. The benefits include:

- Business Interruption providing cover for financial loss due to a hacking attack, cyber theft, ransomware, malware or other cyber attacks

- Third Party Liability resulting from a data breach. This includes claims for individuals or entities for breaching their right to privacy

- Additional Expenses to cover the use of Lawyers, Computer Forensics, Crisis Management, Notification Costs and Public Relations experts

- Fines and Penalties cover including those arising from Mandatory Data Breach Laws

- Social Engineering cover against cyber fraud due to misrepresentation

Get access to Cyber Incident Response services

One of the biggest benefits of a Cyber Insurance policy is the access to your insurer’s Cyber Incident response services. This important benefit provides your business with access to an insurer’s expert cyber response team. Think of this like an emergency assistance team which you can call if you believe your business has fallen victim to a cyber attack.

- Get access to your Insurer’s Cyber Response Hotline

- Access to a panel of expert lawyers who can help co-ordinate your initial response to a cyber attack

- Computer and IT Forensics who can help identify the source of the attack and how to secure your system

- Crisis Management and Public Relations experts

- Notification and credit monitoring services

Implement Cyber Risk Management

The Australian Cyber Security Centre has released a list of strategies to help prevent a cyber threat. These include:

- Ensuring your systems are up to date. In particular the security patches that are released by Windows and Apple

- Take steps to increase your cyber security measures as remote access increases substantially

- Review security measures for Remote Desktop Client Access

- Ensure Mobiles and Tablets used to access your network are secure

- Set up multi-factor authentication for remote access

- Ensure physical security is in place wherever staff are accessing your network

Stay Smart Online has very good information on Cyber Risk Management practices which can help protect your business.

If you would like to find out more about Cyber Insurance, contact the Crucial Insurance team on 1300 400 707 or email info@crucialinsurance.com.au.

This article was written by Tony Venning,

This article was written by Tony Venning,

Managing Director at Crucial Insurance and Risk Advisors.

For further information or comment please email info@crucialinsurance.com.au.

Important Disclaimer – Crucial Insurance and Risk Advisors Pty Ltd ABN 93 166 630 511 . This article provides information rather than financial product or other advice. The content of this article, including any information contained on it, has been prepared without taking into account your objectives, financial situation or needs. You should consider the appropriateness of the information, taking these matters into account, before you act on any information. In particular, you should review the product disclosure statement for any product that the information relates to it before acquiring the product.

Information is current as at the date articles are written as specified within them but is subject to change. Crucial Insurance, its subsidiaries and its associates make no representation as to the accuracy or completeness of the information. All information is subject to copyright and may not be reproduced without the prior written consent of Crucial Insurance.